alaska sales tax on services

Free Case Review Begin Online. With local taxes the total.

Texas Taxable Services Security Services Company Medical Transcriptionist Internet Advertising

Alaska Aviation Fuel Tax.

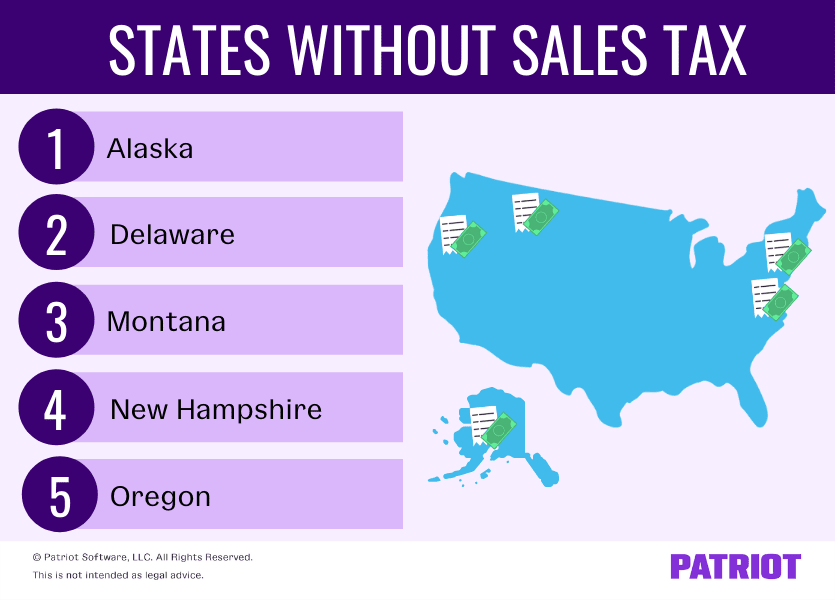

. Sales tax plays an important role in funding the services and infrastructure the people of Juneau rely on. States New Hampshire Oregon Montana Alaska and Delaware do not impose any general statewide sales tax whether on goods or services. However a sales tax is not authorized unless an election is held on the question and it is approved by a majority of the voters.

The state capital Juneau has a 5 percent sales tax rate. Alaska Sales Tax Ranges. 9 cents per gallon.

Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. The City of Wasilla collects a 25 sales tax on all sales services and rentals within the City unless exempt by WMC 516050 see the Sales Tax Exemption page for information about exemptions. Alaska is unique because it does not have a state sales tax which means their State Rate is equal to 0.

Individual towns have broad discretion over tax rates and sales taxes can be as high as 75 percent. 32 cents per gallon. State Office Building 333.

Local Sales Tax Range. The state-wide sales tax in Alaska is 0. Get a demo today.

The Tax Division has adapted to hybrid teleworking but continues to provide the same level of service and work. EBay has collected simplified sellers use tax on taxable transactions delivered into Alabama and the tax of flat eight percent 8 will be remitted on the customers behalf to the Alabama Department of Revenue. Localities within Alaska however do have sales tax.

Remote Seller Filing is Available for Participating Local. 32 cents per gallon. Base State Sales Tax Rate.

Local sales and use taxes must be approved by popular vote. Based On Circumstances You May Already Qualify For Tax Relief. The film credits have six-year expiration dates to be used against Alaska tax liabilities.

47 cents per gallon. If the return was not filed in a timely manner a 25 late fee plus. Alaska Sales Tax Information.

There are additional levels of sales tax at local jurisdictions too. Ad Sales Tax Alaska Same Day. And as many Alaskans can confirm sales tax has been alive and well for many years.

Wayfair decision local governments in Alaska signed an intergovernmental agreement to establish the Alaska Remote Sellers Sales Tax Commission. State law gives municipalities and boroughs broad authority to enact sales tax ordinances and determine what is and is not taxable and very few items are exempt under state law. Local taxing authoritieslike cities and boroughsparticipate in ARSSTC to share their local sales tax rates and taxability information through this portal.

47 cents per gallon. State Substitute Form W-9 - Requesting Taxpayer ID Info. The fuel vendors pay the taxes though the customer ends up paying the taxes since the vendor will.

Charge the tax rate of the buyers address as thats the destination of your product or service. While there is no state sales tax in Alaska boroughs and municipalities are allowed to collect local sales taxes within their jurisdictions. This lookup tool is provided by the Alaska Remote Seller Sales Tax Commission ARSSTC.

There are few exceptions to the application of sales tax and it is the responsibility of the seller to be informed about the taxation of the sale. You can find a list of local jurisdictions that require sellers with economic nexus in Alaska to collect here. The City of Adak levies a sales and use tax of on all sales rents and services made in the city at the rate of 4.

Instead the state recently passed legislation allowing local jurisdictions to elect to require that e-commerce businesses with economic nexus to collect sales tax. Ad See If You Qualify For IRS Fresh Start Program. Additionally it lowers the tax rate to 3 for the period of October 1 through March 31.

While Anchorage and Fairbanks the two largest cities in Alaska do not charge sales tax Juneau for example charges a local sales tax rate of 5. 31 rows The state sales tax rate in Alaska is 0000. The State of Alaska does not levy a sales tax.

Sales Tax is collected on the first 50000 of a sale creating a 1250 tax cap per transaction. Therefore if you are a business entity subject to sales taxes within the state you will need to contact the local municipal government for their particular sales tax regulations and forms. State of Alaska Department Administration Division of Finance.

There are however several municipal governments that do. Sales tax is remitted monthly by the seller on tax return forms provided by the. There are however several municipal governments that do.

The state sales tax rate in Alaska is reviewed on a monthly basis for. In reaction to the 2018 South Dakota v. And travel services for State government.

Produce critical tax reporting requirements faster and more accurately. Total Sales Tax Rate State Rate County Rate City Rate District Rate Special Taxation District. The Commission is comprised of.

The rate changes. Sales Tax Alaska- Current Update Feb 2022. The current statewide sales tax rate in Alaska AK is 0.

The Alaska state sales tax rate is 0 and the average AK sales tax after local surtaxes is 176. Alaska does not have a statewide sales tax but local sales and use tax is permitted and is in effect in multiple jurisdictions. Alaska - Tax Division.

Alaska does not have a state-wide sales tax. The State of Alabama has a program for simplified sellers use tax SSUT under Statute 40-23-192. Welcome to the Alaska Sales Tax Lookup.

The two largest cities Anchorage and Fairbanks do not charge a local sales tax. The Ketchikan City Council recently approved ordinance No. Of the 45 states remaining four Hawaii South Dakota New Mexico and West Virginia tax services by default with exceptions only for services specifically exempted in the law.

At present the State of Alaska does not levy a sales tax. Alaska Jet Fuel Tax. The state constitution and other state law give very broad authority to cities and boroughs regarding sales tax.

District of Columbia State of Alaska Sales Tax Exemption PDF Tax Information. The ordinance establishes a seasonal tax rate of 55 from April 1 through September 30 on all retail sales services and rents subject to sales tax. Therefore the department could see.

Combined Sales Tax Range. The sales tax return and the related remittance of sales tax is due and must be received not merely postmarked by the City not later than 5 pm on the last business day of the month immediately following the month quarter or semi-annual period for which the return was prepared. The Sales Tax office is responsible for business registration filing remittance and record keeping requirements and also offers sales tax exemption cards to senior citizens non-profit organizations and for resale purposes.

State of Alaska Department of Revenue For corrections or if any link or information is inaccurate or otherwise out-dated please email The Webmaster. Our oversight of the Tax Programs has not been diminished with the allowance of broad teleworking. Note the following information.

Alaska has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state.

Where Amazon Collects Sales Tax Map Excel Grid

Amazon Sales Tax E Commerce Business Sales Tax Bookkeeping Services

Illinois State Refund Cycle Chart Elegant Louisiana State Tax Wisconsin State Illinois State Louisiana State

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax District Of Columbia Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Ideas Salestax Small Business Tax Business Tax Tax Write Offs

Sales Tax By State Is Saas Taxable Taxjar

Do I Have To Charge Sales Tax Sales Tax Laws Nexus More

Nebraska Sales Tax Small Business Guide Truic

The Geography Of Taxation Tips Forrent Infographic Study Fun Geography

.png)

States Sales Taxes On Software Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Why Hb 1628 S Sales Tax On Services Is Bad For Maryland Maryland Association Of Cpas Macpa

Amazon Tax Vs Existing State Use Taxes American History Timeline Accounting Services Tax